Accessibility and Equity in Open Financial Learning

This week, I thought about who really benefits from free financial learning resources and who might still be left out. Since I’ve been learning through openly available platforms, I wanted to see how accessible they are for different people. As Hilton points out, free resources remove cost barriers, but they don’t automatically solve bigger issues like access, cultural relevance, or support for learning.

Access to Technology

The biggest factor I noticed is the need for a reliable internet connection. Platforms like Khan Academy, Wealthsimple Learn, and YouTube are technically free, but they still depend on access to a computer or smartphone and stable internet. For many people, that alone can be a significant barrier.

Even the idea of ‘self-directed online learning’ assumes that people are comfortable with technology, which isn’t always the case. Being digitally literate means more than just using a device; it also includes judging online information, navigating tricky websites, and solving technical problems.

Accessibility Features

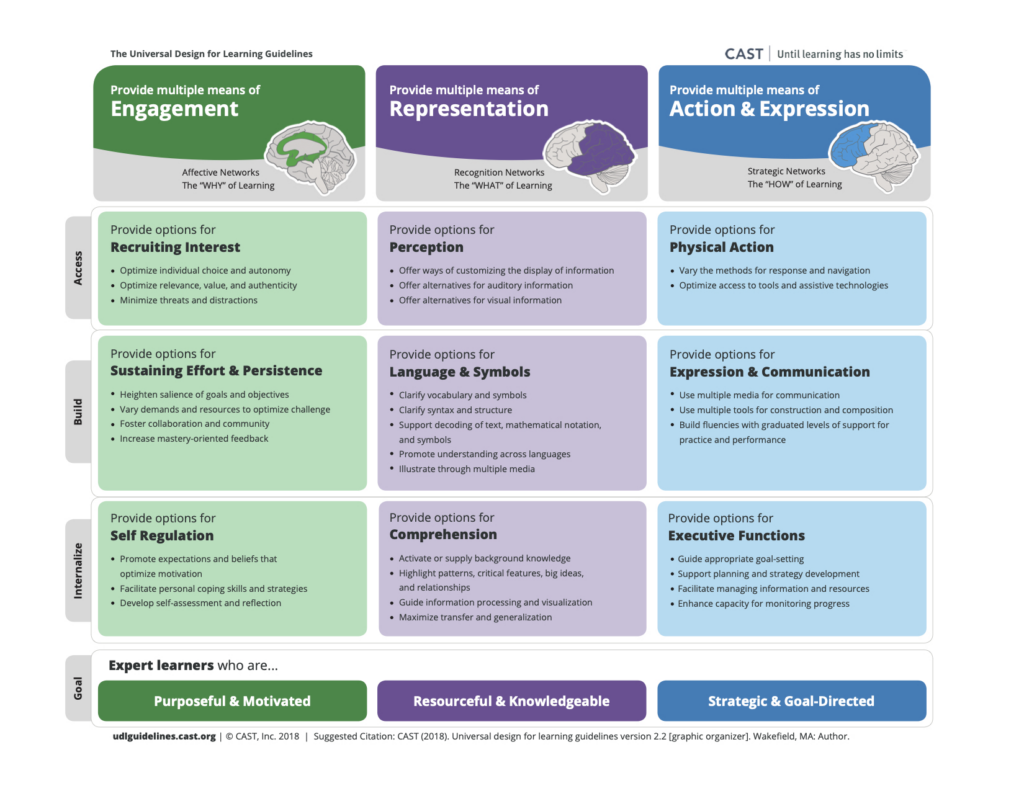

I looked at how well these platforms meet different learning needs using the ideas from Universal Design for Learning.

Khan Academy has subtitles on most videos and a clean, simple interface that works with screen readers. The minimalist design reduces distractions, which helps learners with attention difficulties and lets everyone focus on the content instead of navigation.

Wealthsimple Learn has easy-to-read articles with good contrast and clear fonts, but some visuals might be hard for people with visual impairments. Infographics sometimes don’t have proper descriptions for screen readers.

YouTube varies depending on the creator. Many videos from The Plain Bagel include accurate captions, which is very helpful. Captions benefit not just deaf or hard-of-hearing users but also non-native English speakers and those who learn better by reading. Some creators even offer AI-supported audio translations, which is useful for non-English speakers.

Language, Culture, and Prior Knowledge Barriers

Another important equity issue I noticed is that financial learning often assumes some prior knowledge. Terms like ‘asset allocation’ or ‘market volatility’ can feel overwhelming if you are completely new. Free resources remove cost barriers, but they don’t always make the topic less intimidating.

People usually want quick answers when searching online, and financial terms can slow them down or discourage them before they even start. Learning about finance also takes patience, because one misunderstanding can lead to risky decisions. This shows how important plain language, visuals, and beginner-friendly examples are to make these topics more approachable.

Language barriers go beyond jargon. Most financial education resources are mainly in English, and even when translations exist, financial systems are often country-specific. For example, a TFSA explanation won’t make sense to someone who doesn’t know Canadian tax rules.